![]()

The IRS offers two ways of calculating the cost of using your vehicle in your business: 1. The Actual Expenses method or 2. Standard Mileage method. Each method has its advantages and disadvantages, and they often produce vastly different results. Each year, you’ll want to calculate your expenses both ways and then choose the method that yields the larger deduction and greater tax benefit to you.

TABLE OF CONTENTS

If you drive for a company such as Uber, the business use of your car is probably your largest business expense. Taking this tax deduction is one of the best ways to reduce your taxable income and your tax burden.

This is doubly important because you have to pay two separate taxes on your ridesharing income—once for your income tax and once for your self-employment tax (the amount you contribute as a self-employed individual to Social Security and Medicare). Both taxes are based on the net profit of your business, which can be reduced by taking a deduction for the use of your car for your business.

The IRS offers two ways of calculating the cost of using your vehicle in your business:

Each method has its advantages and disadvantages, and they often produce vastly different results. Actual expenses might produce a larger tax deduction one year, and the standard mileage rate might produce a larger deduction the next.

If you want to use the standard mileage rate method in any tax year, you must do so in the first tax year you use your car for business. In later years you can choose to switch back and forth between the methods from year to year. Each year, you’ll want to calculate your expenses both ways and then choose the method that yields the larger deduction and greater tax benefit to you. If you use the actual expense method in the first year you are required to continue to use this method for that specific vehicle in future years.

Below you’ll find an easy-to-follow road map to choosing the best method for you, this year.

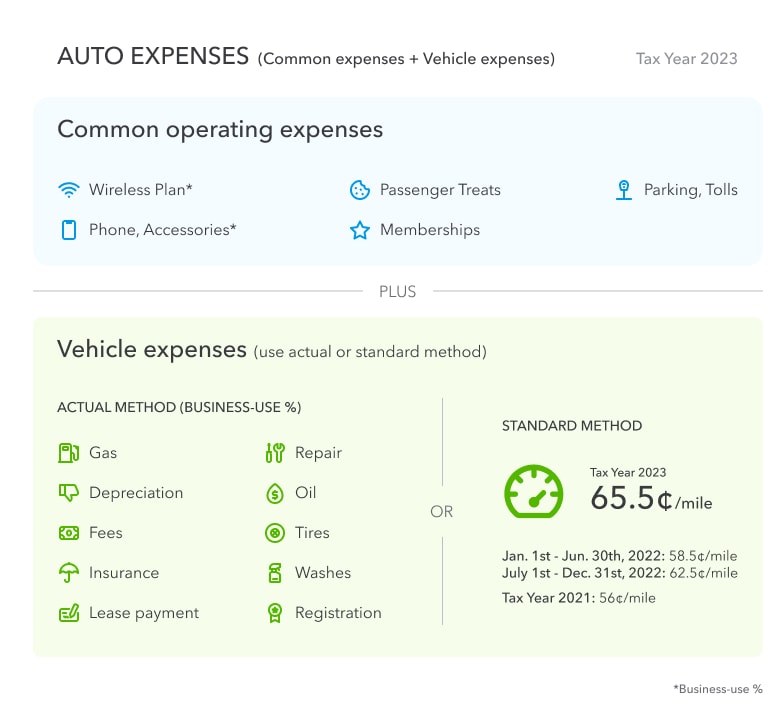

As a self-employed owner of a ridesharing business, you’ll report your business income as well as your business expenses on Schedule C. The chart below breaks total rideshare business expenses into two main groups for 2023:

Many of the items listed in the chart apply both to your business and to your personal use. For example, you might use the same phone and wireless plan for both your business and your personal life.

For this reason, many people use a bank account or credit card separate from their personal accounts for all their business transactions. That way they can refer to their monthly statements or online records to accurately track their business expenses.

As the name suggests, the actual expenses method requires you to add up all the money actually spent in the operation of your vehicle. You then multiply this figure by the percentage of the vehicle’s business use.

Some of the costs you can include in your actual expenses are:

Compute your mileage deduction using each method and then choose the method that yields that larger deduction.

The standard mileage rate method is a much simpler way of calculating the deduction for the business use of your car. It does not require you to track individual purchases and save receipts. Instead, you simply keep track of your business and personal mileage for the tax year. (Tip: Take a photo of your odometer on New Year’s Day and save it, so you can always see where your mileage stood at the beginning of the tax year.)

As with other tax deductions, you'll need to determine the percentage of your mileage that applies to your business.

For 2023, the rate is 65.5 cents per mile. For example if you drove 5,000 miles for business evenly divided throughout the year you would get:

2,500 business miles x $0.585 plus 2,500 business miles x $0.625 = $3,275 standard mileage deduction.

Uber makes it easy to track your miles while using their app. The mileage reported on your Tax Summary includes all the miles you drove waiting for a trip, en-route to a rider, and on a trip. This is a good starting point for calculating your total business miles.

Since Uber does not keep track of the miles you drive without passengers, you’ll need to keep your own mileage log. It should include:

If you don’t want to keep a log by hand, mileage and expense-tracking apps can help you keep an accurate tally of this all-important deduction.

When you use the standard mileage rate deduction, you can’t deduct individual expenses for your car. For example, if your transmission broke down and had to be replaced, you might be better off using the actual expense method to take advantage of this large expense. The only way to know for sure is to keep good records and to calculate your tax deduction both ways.

An Uber partner-driver drove 10,000 miles in 2023, and 5,000 of those miles were for business. The driver’s actual expenses included:

These expenses total $9,500. Since the driver used the car for business purposes 50% of the time, the actual expenses deduction is $4,750 ($9,500 x .50 = $4,750).

Using these same figures to calculate the standard mileage rate deduction, the driver multiplies the business mileage (5,000 miles) by the standard mileage rate, for a standard mileage rate deduction of $3,275.

In this example, the Uber driver-partner is able to deduct $1,475 more by using the actual expenses method than by using the standard mileage rate method.

An Uber partner-driver drove 40,000 miles in 2023, and 30,000 of those miles were for business. The driver’s actual expenses include:

These expenses total $11,300. Since the Uber driver-partner used the vehicle for business 75% of the time, the actual expenses deduction is $8,475 ($11,300 x .75 = $8,475).

Using the standard mileage rate method with these same numbers, the driver would multiply the number of miles driven for business (30,000) by the standard mileage rate (65.5 cents per mile for 2023), which comes out to $19,650.

In this example, the Uber driver-partner is able to deduct $11,175 more by using the standard mileage method than by using the actual expense method.

There are several benefits of using the standard mileage method, including:

However, the standard mileage method isn’t right for everyone. The potential drawback with this method is that you might end up with a lower deduction if you didn’t drive a lot throughout the year.

Consider the pros of using the actual expenses method when preparing to do your taxes:

Some of the potential cons of using the actual expenses method include:

Note that what’s considered a pro or con depends on your circumstances when filing your taxes.

Which method is going to be best varies by taxpayer. When deciding which method to use, some factors you’ll want to think about include:

It’s also important to note that in order to use the standard mileage deduction rate, you must own or lease the vehicle you’re applying the deduction. When in doubt, speaking with a tax professional can help you determine which method you should use for calculating the business use of your car.

Whether you use the standard mileage or standard mileage method, you’ll deduct your self-employed car expenses on Schedule C of Form 1040.

As these examples show, the method you use to calculate the business use of your car can have a big impact on your total business expenses, your net income, and your tax burden. Keep complete records so you can calculate your deduction using both methods, and then choose the one that saves the most money for you.

The standard guidance from the IRS is to keep records of supporting documentation for the property until the period of limitations expires for the year in which you dispose of the property. However, keeping your taxes indefinitely can provide peace of mind and ensure you always have the records to recall should they come into question or if you need to refer to them when filing future returns. You can scan them digitally to keep them secure and save space.

With TurboTax Live Business, get unlimited expert help while you do your taxes, or let a tax expert file completely for you, start to finish. Get direct access to small business tax experts who are up to date with the latest federal, state and local taxes. Small business owners get access to unlimited, year-round advice and answers at no extra cost, maximize credits and deductions, and a 100% Accurate, Expert Approved guarantee.